Seamless Payroll Solutions

Simplify payroll processing with error-free automation, reducing manual tasks. Ensure smooth salary distribution and compliance with all legal requirements.

Simplify payroll processing with error-free automation, reducing manual tasks. Ensure smooth salary distribution and compliance with all legal requirements.

Streamlined Payroll Features for Better Management

The Payroll Summary provides an overview of employee compensation for a specific pay period, detailing gross pay, deductions, and net pay for accurate financial reporting.

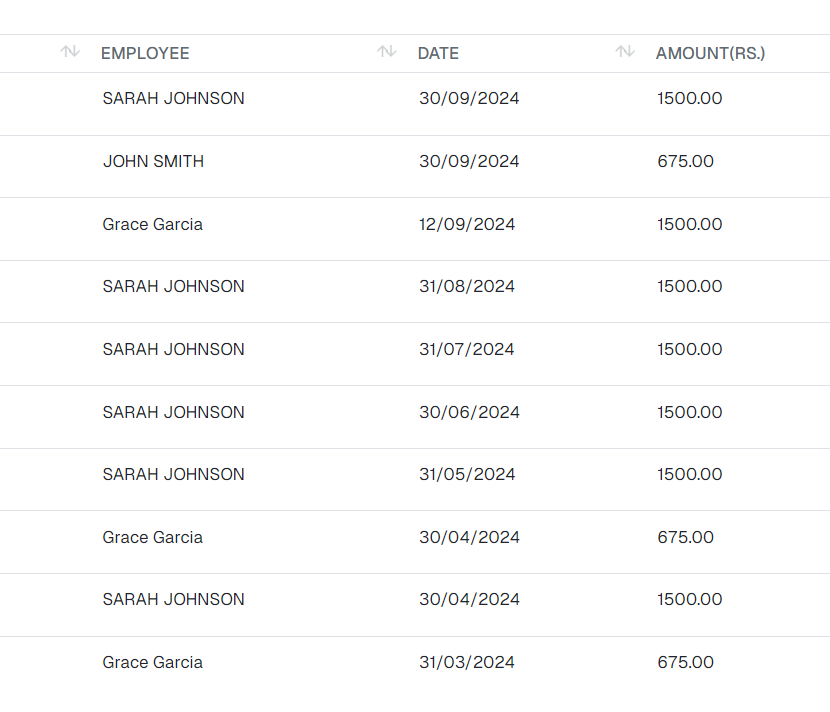

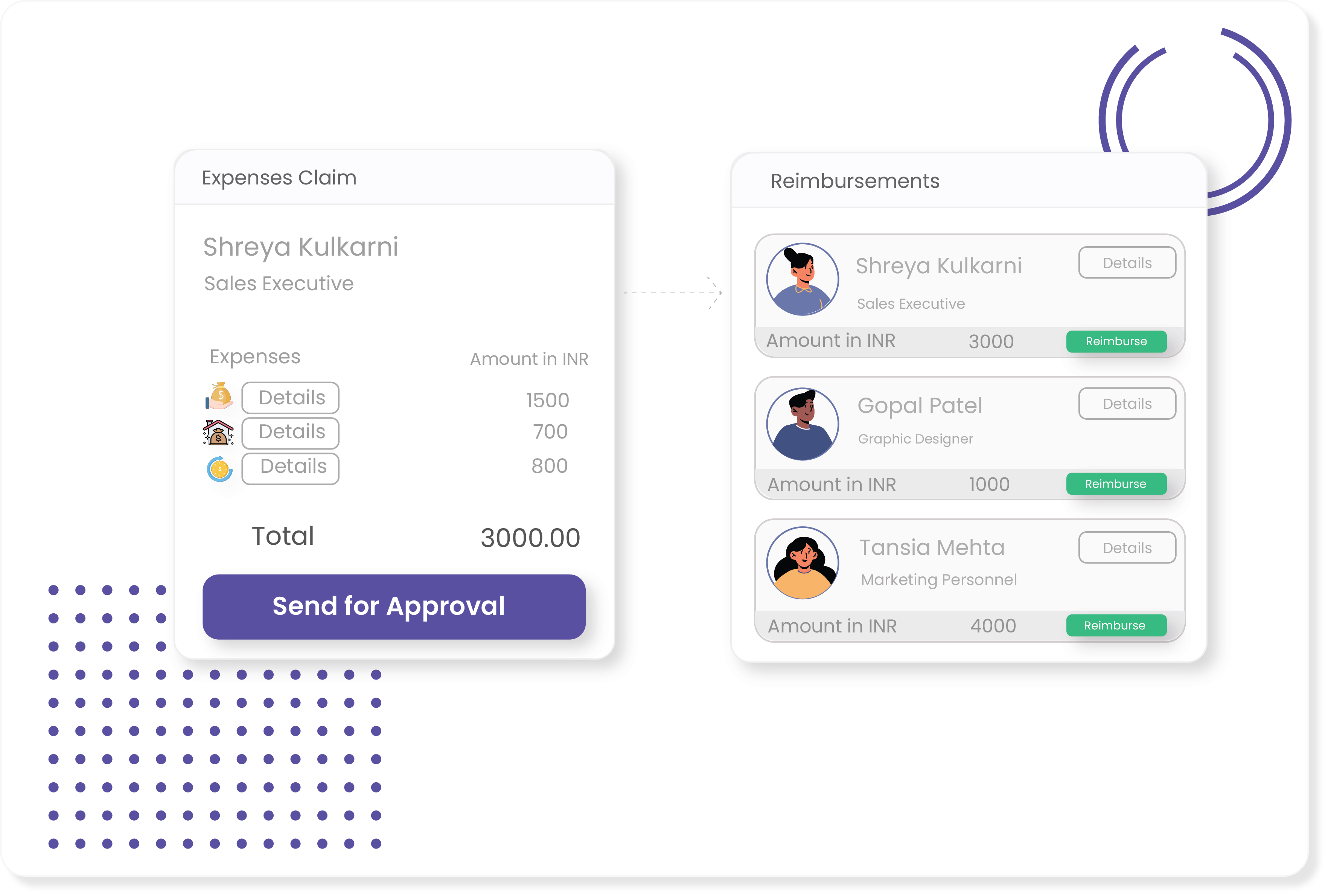

Reimbursements refer to the process of repaying employees for expenses incurred during the course of their work, such as travel, supplies, or other business-related costs.

TDS Deductions refer to the tax deducted at source from payments made to individuals or entities, ensuring that tax is collected at the point of payment rather than at the end of the financial year.

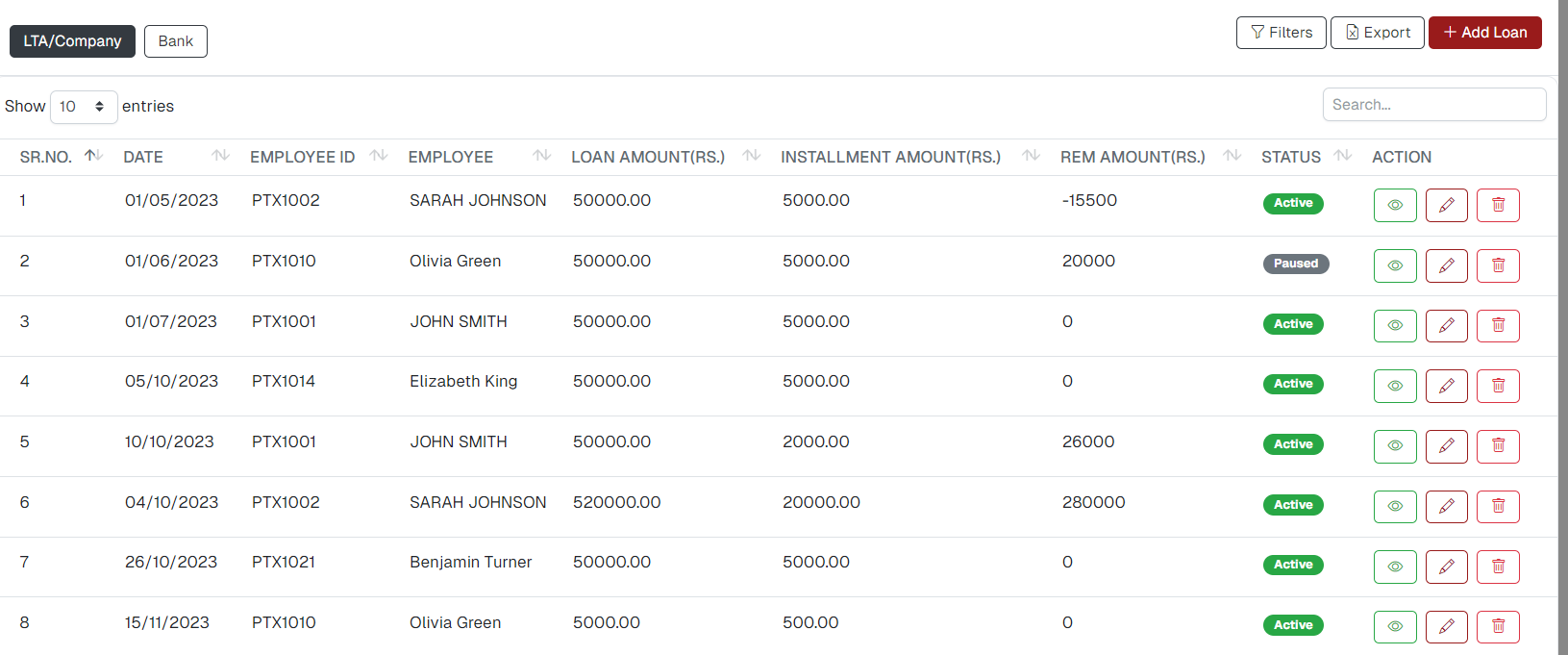

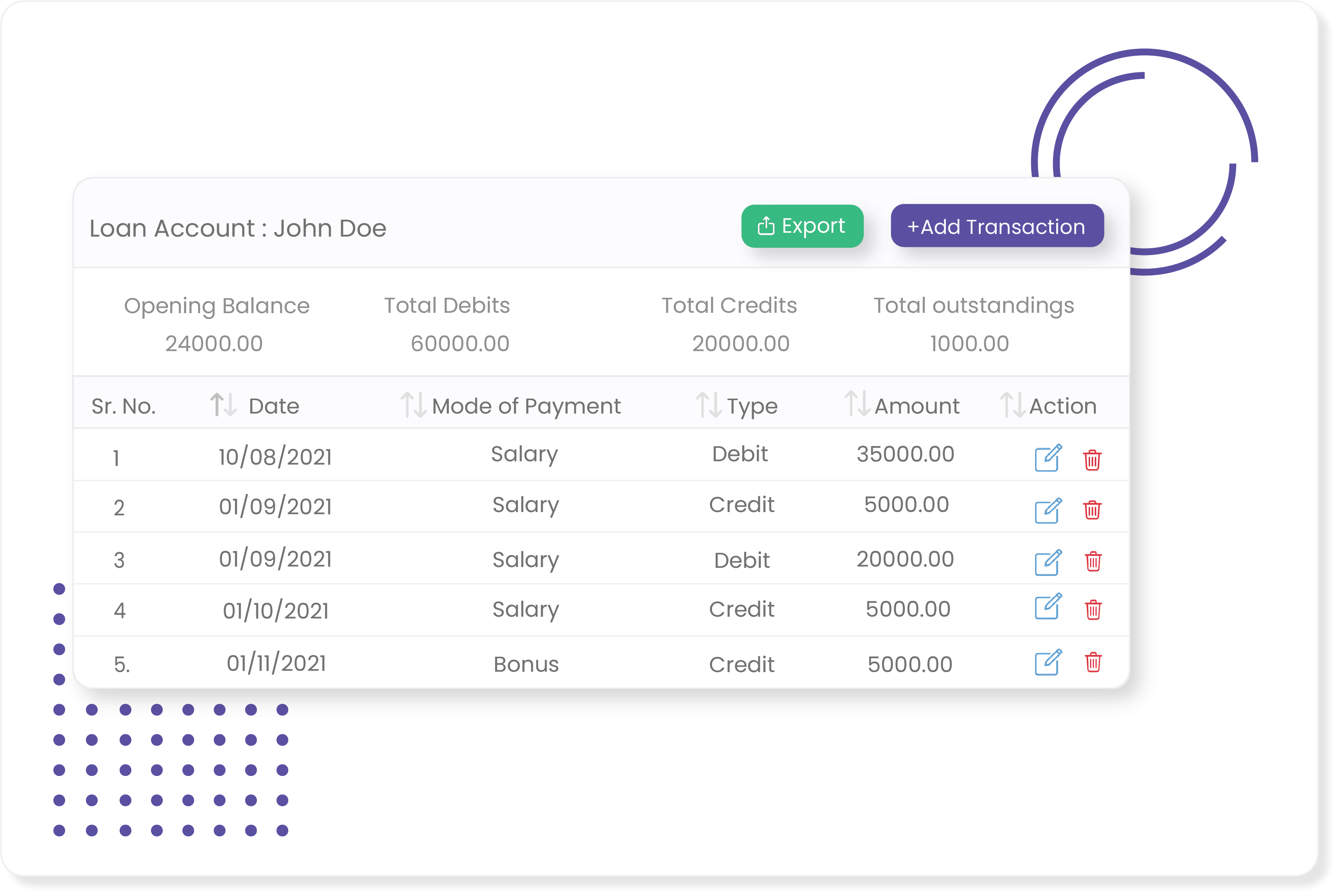

A loan is a sum of money borrowed from a lender that is expected to be paid back with interest over a specified period. Loans can be secured by collateral or unsecured, depending on the borrower's creditworthiness and the lender's requirements.

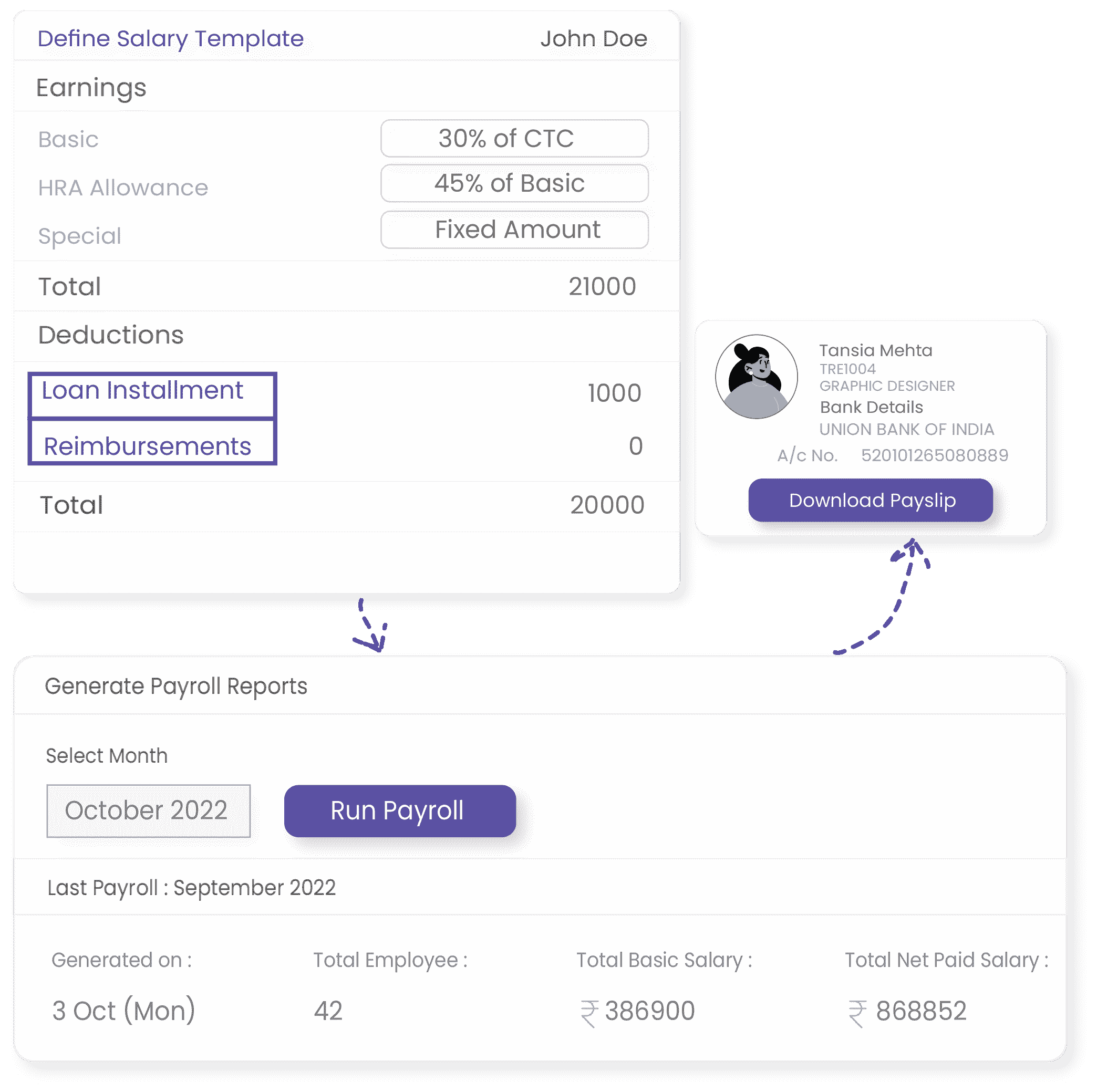

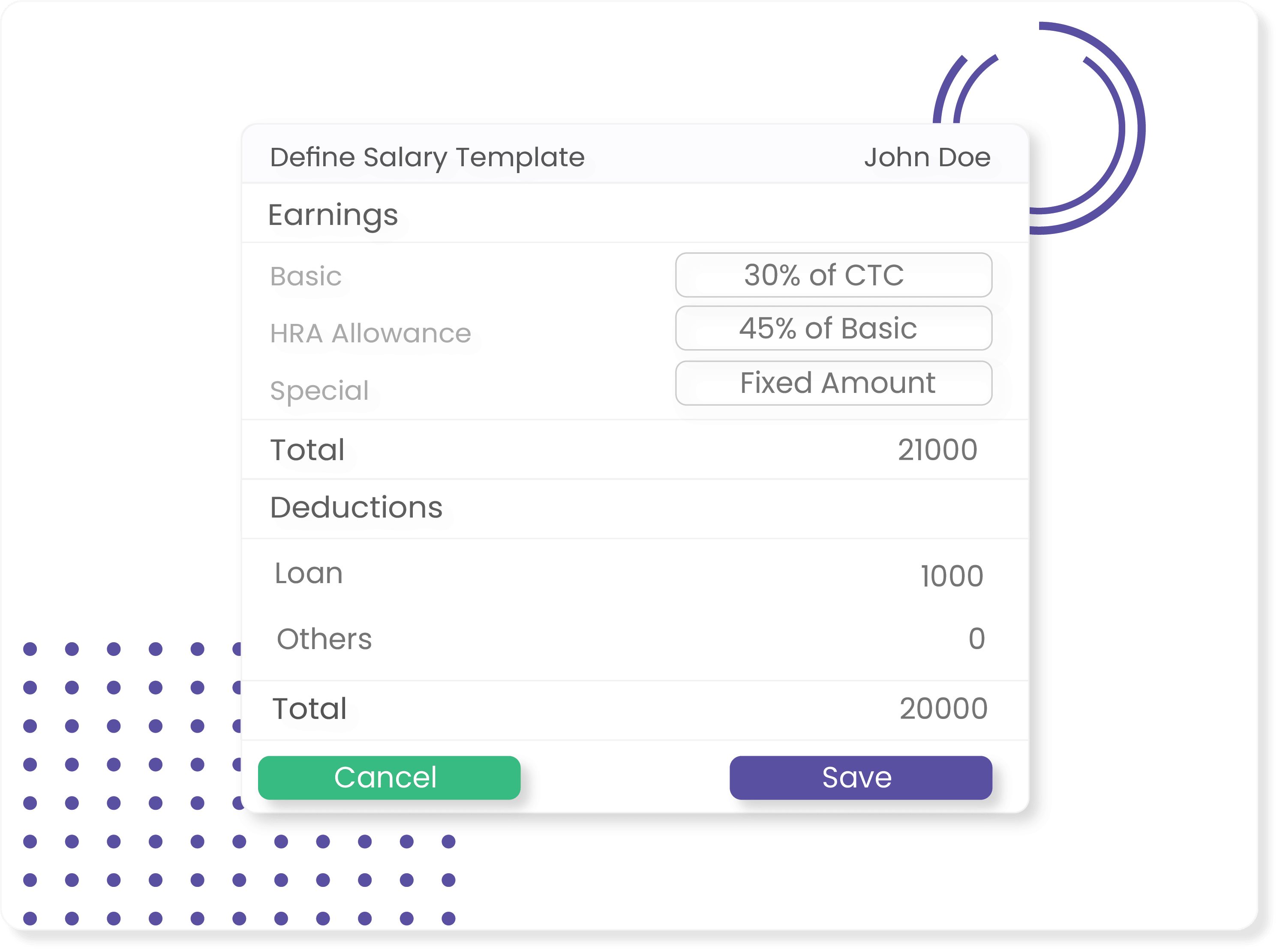

Define your salary components

Streamline payroll processes, ensure accuracy, and efficiently manage employee compensation with a flexible and customizable system for defining salary components.

Functional Structure

Functional Structure

Branded Payslips

Branded Payslips

compliances & Taxes

compliances & Taxes

Loans & Advances

Loans & Advances

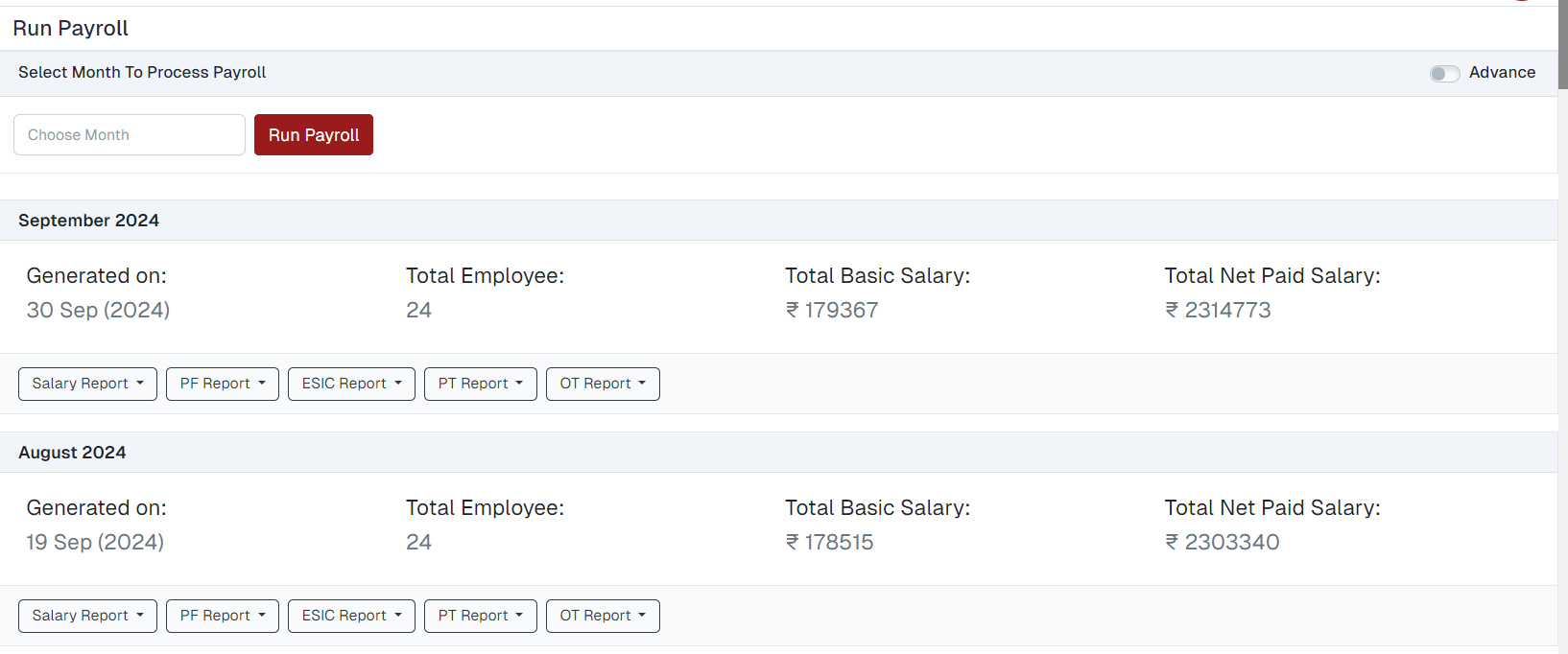

Manage Reimbursements & Expenses

Enhance accuracy, reduce paperwork, and efficiently manage employee expenses with a user-friendly and automated system for managing reimbursements and expenses.

Streamlined Processes

Streamlined Processes

Cost Control & Compliance

Cost Control & Compliance

Real-Time Visibility

Real-Time Visibility

Enhanced Employee Experience

Enhanced Employee Experience

Track loans and advances

Enhance financial transparency, ensure compliance, and simplify loan and advance management with a comprehensive system that enables efficient tracking and administration.

Efficient Record Keeping

Efficient Record Keeping

Data-Driven Decision Making

Data-Driven Decision Making

Automate Workflow Alerts

Automate Workflow Alerts

Employee Transparent

Employee Transparent

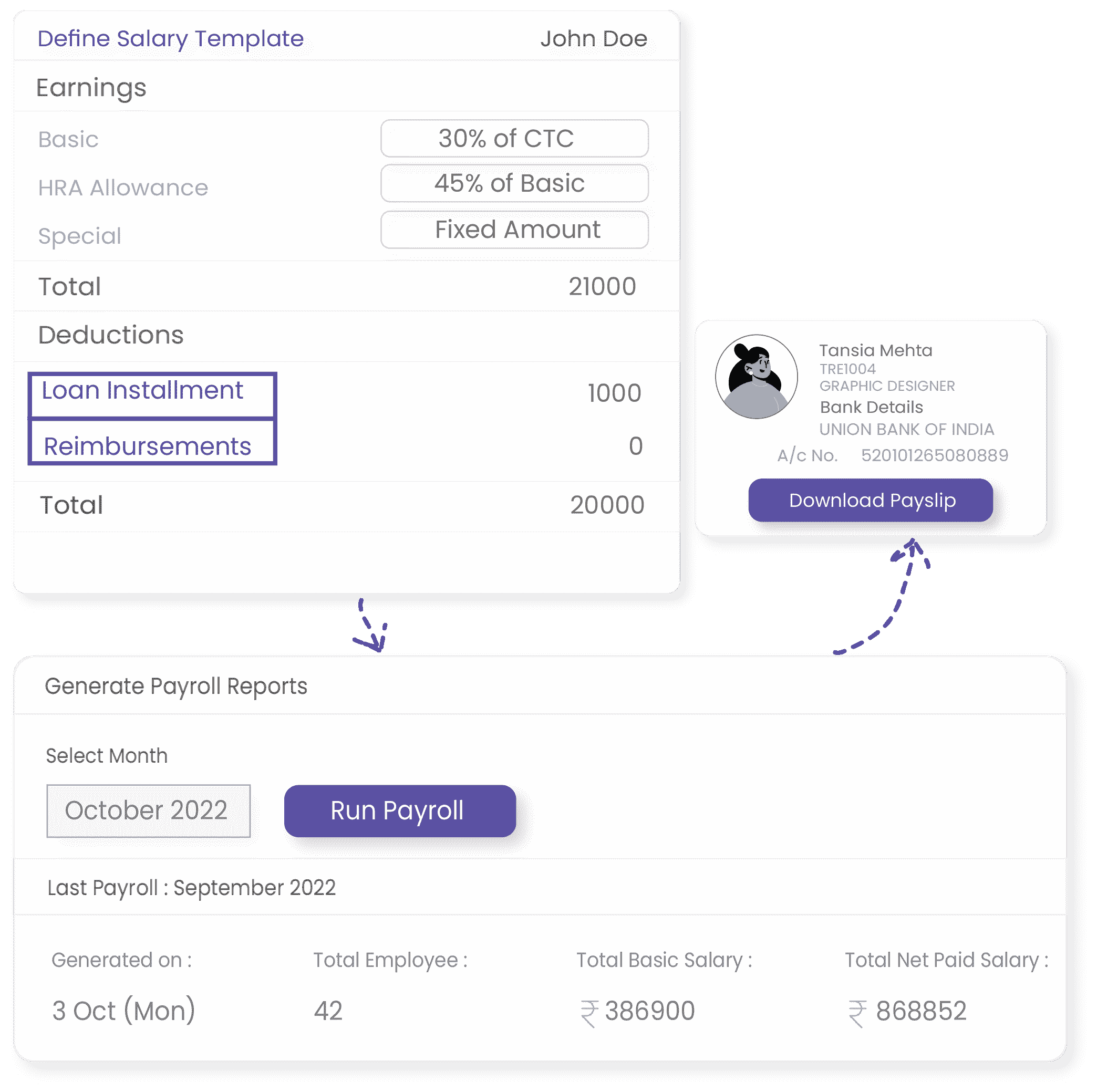

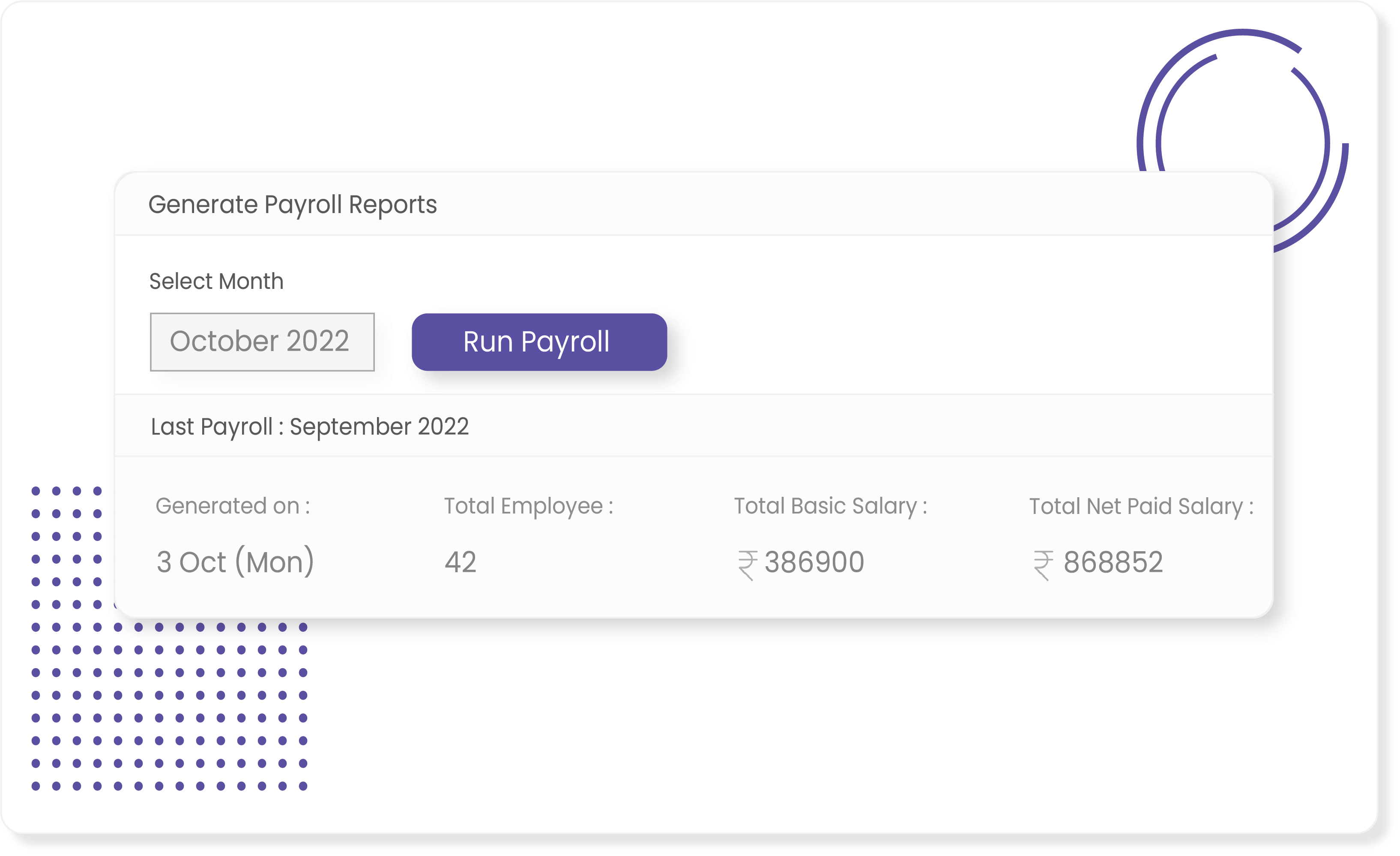

Process Payroll within minutes

Process payroll with speed and accuracy using our HRMS software, completing the task within minutes. Automate calculations, deductions, and tax withholdings, while ensuring compliance with labor regulations.

Efficiency & Time Savings

Efficiency & Time Savings

Accuracy & Compliance

Accuracy & Compliance

Security & Data Integrity

Security & Data Integrity

Maximize Employee Satisfaction

Maximize Employee Satisfaction

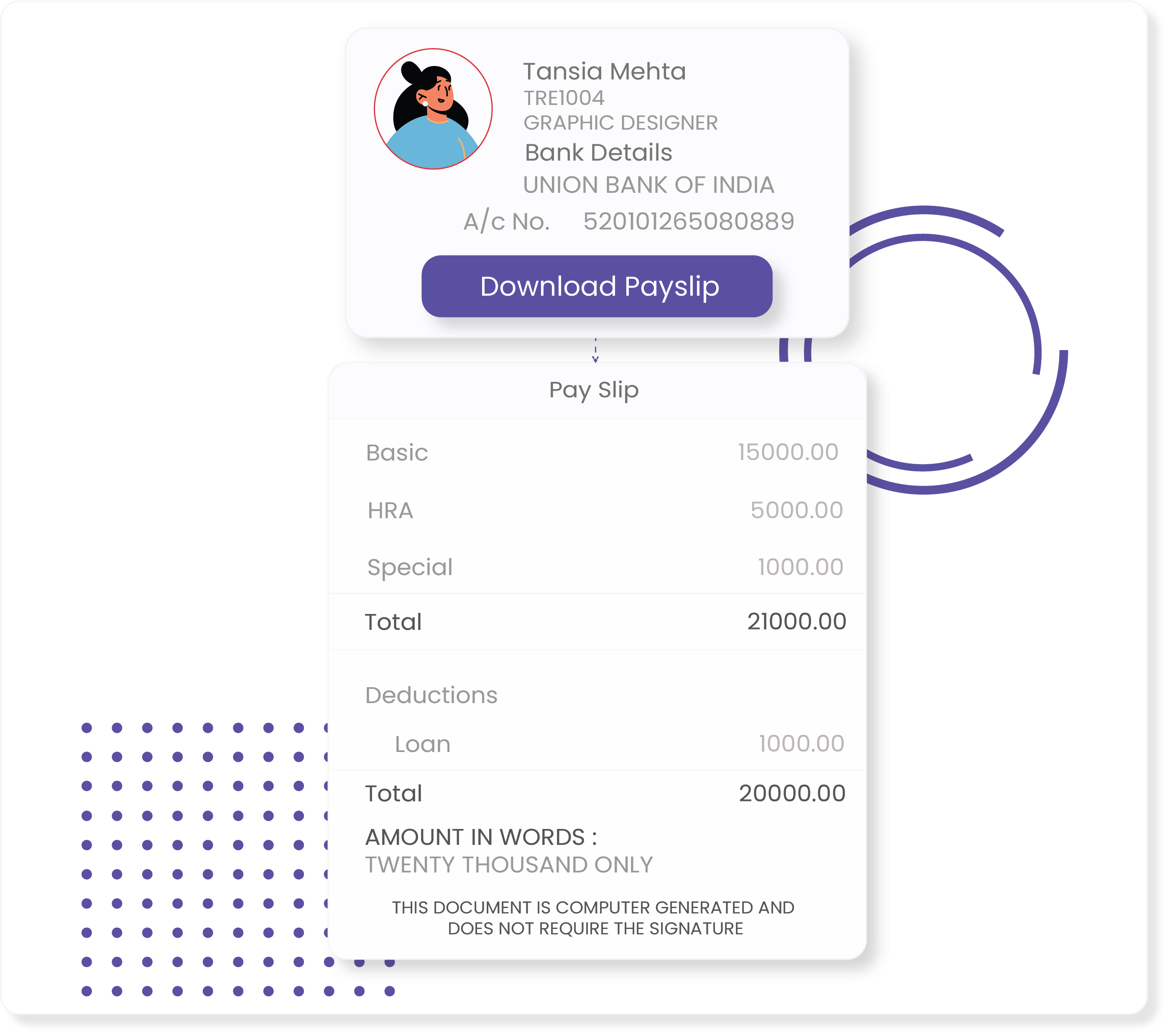

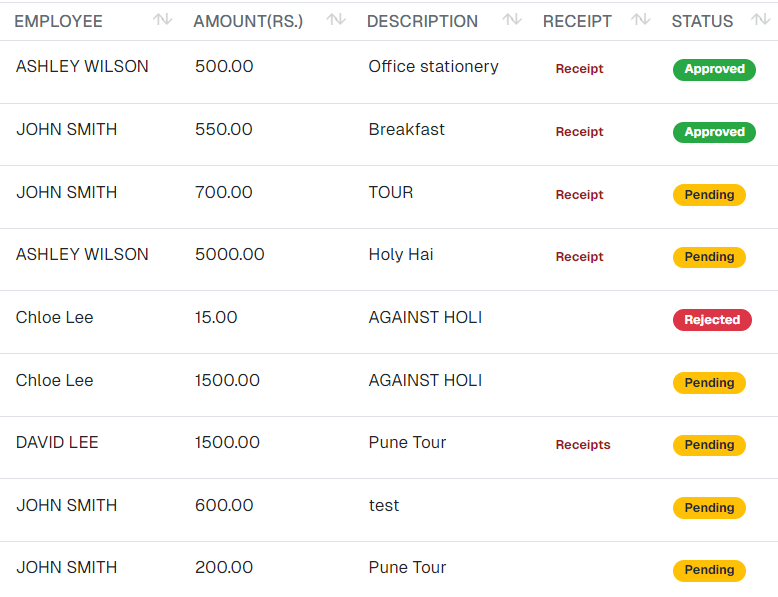

Distribute branded payslips to your employees

Deliver professional and branded payslips to your employees seamlessly with our HRMS software. Customize and distribute digital payslips that reflect your company's brand identity.

Image & Brand Visibility

Image & Brand Visibility

Compliance & Information Clarity

Compliance & Information Clarity

Communication & Brand Loyal

Communication & Brand Loyal

Brand Consistency & Recognition

Brand Consistency & Recognition